To shop for a property are a daunting process, particularly when it’s your basic family. Due to the fact purchase of a property is the biggest financial support a lot of people is ever going to create, the notion of to shop for property are overwhelming. But not, when you are an initial-date homebuyer, reduce any concerns by simply familiarizing your self which have how homebuying process really works. Whenever you are a first-time homebuyer when you look at the Ca, all of our action-by-step book is to help you to get a better understanding of what to anticipate regarding property techniques as well as how you could potentially create go given that efficiently as possible.

First-date homebuyers into the Ca is actually identified as buyers who have never payday loan Holt ever had property before. But not, it is worth bringing-up you could nevertheless be eligible for certain family mortgage applications created to assist first-time homebuyers even though you had been a resident from the one point. Such as, even in the event FHA (Federal Housing Management) funds was designed for basic-day homeowners, you could qualify providing you haven’t had a property for around 36 months before the acquisition off your brand new household.

Place Your goals

Once you have decided becoming a citizen, there are certain things to consider before you start considering homes. It’s appealing to begin with house browse instantly, but doing this was truthfully a waste of day for individuals who have not invested sometime determining just what you are searching for. First thing you need to do will be to lay your own wants.

Simply how much Might you Afford?

Going family query in the place of a budget is a significant waste off big date. There’s absolutely no part of deciding on qualities that you can not pay for. Take the time to ascertain how much cash you might afford, considering your obligations. This can include one another costs and you can month-to-month expenses.

Remember concerning associated will set you back away from homeownership – you will not only have to create a down payment (if you do not qualify for yet another financial system), but you’ll also have to shell out homeowner’s insurance coverage, HOA charge (when the you’ll find any), possessions fees, electric can cost you, prospective repair and you will repair will cost you, and you can financial insurance coverage (unless you’re capable of making an advance payment out-of 20% or even more).

Even though you rating pre-eligible to a mortgage, analysis due diligence and draw up a monthly finances. Even though you qualify for a large mortgage does not always mean your are able property at that selling price.

Purchasing a separate house is far diverse from to buy a classic house. Choosing what sort of domestic you desire will help slim something down a lot when you start house hunting, helping you save way too much date. Old homes will often have way more profile than this new home and are usually generally speaking readily available for all the way down rates; but not, newer houses tend to be more opportunity-successful and you will armed with new equipment and devices. Dated houses are also very likely to enter necessity of several solutions otherwise renovations than simply newer house.

What sort of Mortgages Will you be?

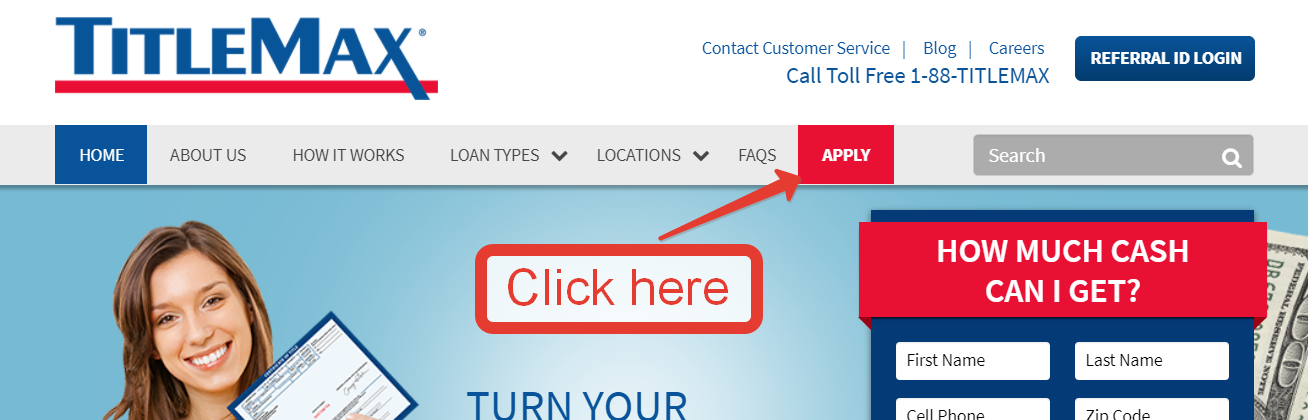

The conventional way of getting that loan would be to visit your neighborhood financial and implement getting a conventional mortgage. Although not, it is really not the only method to see a mortgage. When you yourself have limited financing and you may less credit history (otherwise haven’t had the opportunity to build far in the way off a credit rating), you might explore some other choices. Such, FHA loans require shorter off money off 3.5 per cent.

Other programs that you need to look into are Virtual assistant finance (if you find yourself a veteran), which require zero down-payment, and you will USDA money, you may possibly qualify for if you are searching to order property inside the an outlying or suburban town. Never restrict yourself to old-fashioned fundseek information to see if you can find finest solutions out here to suit your certain financial predicament.